Yesterday I had a meeting with TAP, (the local electronic payment company) since they wanted to let me know of some new things they’ll be introducing in a couple a months time. I can’t disclose any of it for now but while meeting with them I did manage to get some details on their current services. To be truthful, I wasn’t a fan of TAP before my meeting and that’s mostly because of the ridiculous no desktop browser rule they had in place. Basically on more than one occasion when I wanted to pay for an item using their service, the link the seller provided wouldn’t work from my computer. Turned out their service would only work when using a mobile phone browser and I thought that was the dumbest thing ever. There was no technical reason for it, they just decided not to allow people on desktops from using their service. Not very practical especially when I would link to workshops on my event page that required TAP payments. Thankfully, this annoyance will be solved with their upcoming updates.

With that rant out of the way, what I wanted to write about in this post is how their payment system is actually really great for home and small businesses in Kuwait. When I was starting a company and wanted to setup a payment system for an online store, the fees involved were ridiculous. Firstly you needed to be an officially registered business which means home businesses couldn’t setup an online payment system. Secondly the cost involved was just too high, depending on the bank you would pay a setup fee of around KD750 (KD1,000 in some cases), then a monthly fee ranging from KD25 to KD50 depending on the bank and then on top of that a charge per transaction, 1% for debit cards and 3% for credit cards. So if you’re just starting up those fees could be pretty brutal.

TAP on the other hand offer two services for home and small businesses and in both services you do not have to be an officially registered business.

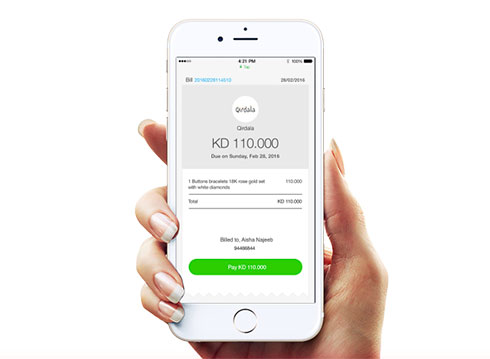

GoCollect

The first service is called GoCollect. Say you have an instagram account and you sell cupcakes out of your home, when someone places an order with you through whatsapp, you would provide them with a link that will send them to the TAP website where they could pay you either with a debit card or credit card. There is no setup fee for this service and you can sign up to it from the TAP website. You could be up and running in less than 24 hours. TAP make their money with transaction fees, they charge 200fils 2.5% per debit card transaction and 3% for credit card transactions. TAP gets your customers money and then deposits it into your account. You don’t have to be dealing with a certain bank either, they work with all local banks.

GoSell

The second service they offer is called GoSell. This is for small businesses that have an online store. Say you’re selling tshirts and you created an online shop using one of the online services like Shopify, Magento, WordPress or whatever, TAP would provide you with a plugin (or API for pros) that would allow you to integrate their payment system with your ecommerce website. They charge around KD300 to set this up for you, maybe a bit less, maybe a bit more depending on the size of your business and then like with GoCollect, they charge 200fils 2.5% per debit card transaction and 3% for credit cards. No monthly fees.

If you’re a home or small business or thinking of starting a business then this is currently the easiest way to setup a payment system. If you want to find out more you can visit their website for more details [Here]

Update: I was informed by TAP to replace the 200fils debit card transaction fee in my post with 2.5% since they don’t have a fix rate. Depending on the size of your business and your negotiation ability the debit card transaction fee could be 200fils, could be 1%, could be 2.5% etc.. it varies

16 replies on “Payment System for Home and Small Businesses”

i love you for this! thank you so much, first time i heard about them

the legality is still unclear here, that’s why K-net has such high requirements for vendors to apply

say you paid for something you saw on Instagram on tab, you got cheated, who is supposed to refund you..etc etc

i think the CBK have to create some regulations that regulate these transactions before we see widespread of real ecommerc

‘There was no technically reason for it,’

There was technically no reason for it

Thanks

I can’t find the app in google store, Looks like they don’t have android app yet

They don’t, just the iPhone app, the android one is in beta for now

There is madhmoon you know !!

https://www.madhmoon.com/Faq

In the Go Collect Para

“You you could be up and running in less than 24 hours.”

You You 🙂

One Day Mark…you will have the perfect blog post…

Lol

I’m sorry, but I find this completely useless. Go to any bank and they charge 300KD installation fee then charge 2.25% on Visa/Mastercard transactions and 0.25KD per Knet transaction. Oh and the monthly fee is 10KD per month.

However, in order to get the above rates you have to be a registered company, hence tap is convenient for people who do not operate under official license from Kuwait. (which is illegal BTW)

You start of saying its useless but then saying its convenient for people who don’t have a license. So which is it, useless or not useless?

Secondly not sure what bank you got your rates from but I have the following rates from NBK and Burgan Bank:

NBK

KD600 to setup Knet

KD400 to setup Credit Cards

Monthly Fee KD50

1% charge per debit transaction

3% charge per credit transaction

Burgan Bank

KD700 to setup Knet + Credit Card

Monthly Fee KD25

0.5% charge per debit transaction

2.5% charge per credit card transaction

Since you’ve got a registered company and aren’t a home or small business you’re clearly going to find TAP useless. But, this service isn’t aimed towards you hence the title in which I clearly state “Payment System for Home and Small Businesses”

My issue is with how these companies facilitate things for people selling goods and services from home. Don’t get me wrong, I am pro the free market concept but as a company you are bound by law to pay the extra rent for office space and other ridiculous fees, not to mention the paperwork (this is especially applicable to Kuwait). And at the end of the day people complain why they pay the extra premium when they buy goods from a company and not from individuals selling from home. With such transactions consumer rights cannot be monitored, you buy something that isnt what you paid for or that breaks with no after-sale and there is no legal action that can be taken.

We keep getting news that something will be done about it to protect the consumers and the companies, but nothing is ever done.

Personally I think the first step to protecting the consumer’s rights is by shutting down companies that facilitate this kind of work.

The government is actually making it easier for home and small businesses to get started. You no longer need an office space, you can start a business from home and the process to set up the business takes 30 days, you apply for it online and requires just 1 visit to the newly opened Kuwait Business Center https://kbc.gov.kw/

I took a look at the website, most of the links provided are in Arabic or if in English, aren’t providing information about incorporation of home and small businesses.

If you can please guide a little more on that?

I wonder if this service can be used by landlords to receive rent from tenants. I was thinking it would be great if I could convince my landlord to set this up ( and offer to pay the 2.5% or 3% fees) so that I can use my credit card to pay the rent and rack up some reward points on it ( and most likely miles), as rent is usually my biggest monthly spend.

I guess also another issue would be whether the reward points/miles/cash back is worth paying the extra 3% or if it evens it out eventually..

Welcome to the most useless app.

if it pays for psn and xbox live i’d use it.

otherwise, it’s pretty useless.

I got paypal and it’s alot better, you can use it in ebay.