Just saw that BoingBoing posted a link to the 100 oldest domain names. I thought I had posted it here ages ago but it turns out I posted it in a forum back in December before I had this blog. Anyway here is the link to the 100 oldest dot com domains. [Link]

Category: Information

100 Oldest Domains

Famous Lebanese

Thanks to Purg for the link to this site with famous Lebanese. Here are some interesting ones I didn’t know about:

Nicolas Hayek, creator of Swatch and savior of the Swiss watch industry.

Marisa Tomei, winner of Best Supporting Actress Oscar for her performance in “My Cousin Vinny”

Frank Zappa, rock legend

Yasmine Bleeth, starred in “Baywatch” and “Nash Bridges”

G.E. Smith, guitarist and “Saturday Night Live’s” bandleader for many years (Smith is the translation of is family’s Lebanese name, Haddad)

Kathy Najimy, award-winning comic actress, the fun-loving nun in the “Sister Act” films and co-star of Kirstie Alley as Olive in “Veronica’s Closet”.

Tom Shadyac, director of Ace Ventura: Pet Detective(1994), The Nutty Professor (1996), Liar Liar (1997), Patch Adams(1998), Dragonfly (2002) and Bruce Almighty (2003)

Ned Mansour, president of Mattel, Inc.

Paul Orfalea, founder of Kinko’s

Here is the full list. [Link]

Update: Here is another list from a more reliable source. [Link]

Update 2: Wendie Malick is of Irish and Lebanese heritage. She plays Nina Van Horn on NBC’s hit show Just Shoot Me. [Link]

Aramex Pissing You Off?

Send them a complaint. [Link]

DSL Price Updates

DSL prices in Kuwait have gone down recently. Both Qualitynet and Fasttelco have double the bandwidth. It started off as an offer but it seems they have decided to keep this permanently. This is how much 512KB will cost you in Kuwait

Fasttelco

512kb down / 128kb up

1yr Subscription Price: KD360 ($1232)

Qualitynet

512kb down / 256kb up

1yr Subscription Price: KD380 ($1300)

Both providers are reliable, I use both of them, one at home and one at work. Sometimes a site could be blocked by Qualitynet and not by Fasttelco, and sometimes its the other way around, they mostly come out even. So if you are new in Kuwait and looking for a decent connection, get a 512kb DSL connection, the 256kb is too slow, and the 1MB too expensive, 512kb comes in nicely at around KD30 a month.

Tara Reid Rocks!

10 Biggest Party Animals in Hollywood poll, compiled by American magazine In Touch.

1. Tara Reid

2. Sean ‘Diddy’ Combs

3. Paris Hilton

4. Avril Lavigne

5. Wilmer Valderrama

6. Colin Farrell

7. Jessica Simpson

8. Jamie Foxx

9. Lindsay Lohan

10. Owen Wilson

Two pictures of the same street, one from 1991 and one from 2005. It’s amazing how fast Dubai grew, I have seen pictures of Kuwait from 1983 and the places still look the same today! [Link]

[via]

Forklift and Golf Cart Prices

Ever wondered how much a forklift or an electric golf cart costs? I always did so I past by a place yesterday that sells both and here are the prices. You can get a forklift for KD9000 ($30,800) while a golf cart would set you back KD2200 ($7500).

Lulu Supermarket

Ummm what happened to the new Supermarket called Lulu that was supposed to open in Rai adjacent to the 4th Ring Road? I past by it last night and the Lulu Supermarket sign is down and replaced by “Dream Mall” or something like that. How did the supermarket that was gonna try to take over the market turn into a mall??

SuprNova.org is Back

The SuprNova.org code is now back and being used on NewNova.org. This means I need more Hard disk space. [Link]

NHL New Rules

The new NHL season just started after the cancellation of last years season. This time they are back with a new look and a new set of rules. To learn more about the new rules check this link. [Link]

Update: I just realized I haven’t watched Hockey since like 1994. Back then the Toronto Maple Leafs were my favorite team and they had Matt Sundin, Doug Gilmour, Felix Potvin and Dave Andreychuk. Now none of my favorite players are still with the Leafs, sucks.

My Visit to the Mac Store

Last week I posted some prices from the new Mac store that opened up in Kuwait called zMacShop, well tonight I past by it and I posted my experience on Miskan.com. So check it out. [Link]

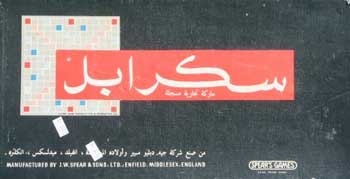

Arabic Scrabble?

If You Break Fast

Citizens and expatriates, who eat or drink in public places during the Holy month of Ramadan, will face a penalty of upto 100 dinars ($342) and/or a 30-day jail term.

You are warned.

Jazeera Airways Prices

Here are the prices for round trip tickets including all the taxes:

Kuwait – Amman – Kuwait: KD76

Kuwait – Bahrain – Kuwait: KD33

Kuwait – Beirut – Kuwait: KD82

Kuwait – Damascus – Kuwait: KD70

Kuwait – Dubai – Kuwait: KD66

Jazeera Airways seems to be all the buzz lately, I was a great fan of Kuwait Airways but it seems lately they have turned into trash (last time I used them was 4 years ago). So me and Nat were planning our trip to Lebanon on Christmas and I decided to give Jazeera Airways a shot, I was impressed.

I went to the Jazeera Airways website to check out the prices and stuff when I noticed a button to Book a flight. I clicked on it out of curiosity and started filling up some forms. 10 minutes later I had purchased two, two-way tickets to Lebanon. The whole process felt like I was ordering movie tickets online, it was too easy. The coolest part about the whole thing was I was actually able to book my seats on my flight to Lebanon and on my flight back to Kuwait. No one else had purchased or booked tickets for the two flights I was on so the whole plane was empty and I was able to get 2 seats on row 10 for the trip going and coming. When I was done paying for the tickets I received an email with all the details about my flight, my reservation number and my invoice, its like shopping on Amazon.

The booking and paying online, plus the fact I could reserve my seats ahead of time had already impressed me, but the biggest seller was the price. Two, two-way tickets to Lebanon cost only KD164 (with taxes and everything) during peak season. Kuwait Airways or Middle East Airlines would have cost around KD135 per ticket and they wouldn’t have allowed me to reserve my in flight seats ahead of time. So thats a total saving of over KD100 which I could now spend on 600 bottles of beer or 4 bottles of Jack Daniels at B018.

The only downside to Jazeera is that if you want to eat on the plane you have to pay for it. They serve cold sandwiches and drinks but they are not free which I don’t really think is a big problem anyway. For those of you who want to travel in style and not economy, for an extra KD26 per ticket per one way you can sit in first class. That would put the price similar to the Kuwait Airways or MEA regular economy ticket price though.

Finally, I called them up a few times on the phone (177) for details and info and the people I spoke to were very friendly and polite which made me feel more comfortable. Now the only thing left is to fly with them, my flight is in December so I will review it when I come back.